Investment process

Investment profile

The process begins with a thorough assessment of your financial circumstances and investment objectives to create your bespoke investment profile. This will include information such as:

- Personal information, financial dependents, tax status etc

- Employment income and/or investment income

- Any requirement for income and/or capital

- Knowledge and experience of investments and whether you understand the risks associated with investing

- Investment objectives and whether these are achievable and realistic

- Understanding your investment time horizons

Obtaining this information is an important component of the investment process as it provides your wealth manager with the foundations they need to create your bespoke investment portfolio. It can also help build a long and trusted relationship between you and your wealth manager.

Risk tolerance and risk profiling

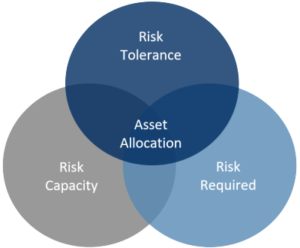

Risk profiling is important part of the investment process. It’s used to determine the optimal level of risk required to achieve your objectives (risk required) while taking into consideration how much risk you can afford to take (risk capacity) and how much risk you’re willing to take (risk tolerance).

Risk required – the risk associated with the return required to achieve your goals and objectives from the financial resources available.

Risk capacity – the level of financial risk you can afford to take.

Risk tolerance – the level of financial risk and volatility you’re comfortable with.

Asset allocation – the split of different types of assets, usually equities, fixed interest, property and cash. How a portfolio is divided into these asset classes is the most important driver of investment performance and volatility.

Balancing your risk tolerance, capacity for loss and risk required is a fine art and it’s unlikely that they will match each other. For example, you may be willing to accept a high degree of risk, but your financial circumstances indicate that you can’t take much loss without a significant impact on your standard of living; or the risk you need to take to achieve your objective is very high but your willingness to take risk is low.

In practice this will involve you making judgements and decisions about the level of risk you wish to take with your investments. To help you, your experienced wealth manager will discuss any discrepancies with you and agree the most appropriate strategy based on the details you’ve provided.

Asset allocation

Once you have an agreed strategy, your wealth manager will blend the correct mix of defensive assets (fixed income, cash) and growth assets (equities) to create your bespoke investment portfolio. Other asset classes, such as alternative investments and property, may also be used. This approach significantly increases the diversification of your portfolio and therefore reduces the overall risk.

Strategic asset management

The core asset allocation of your portfolio is based on several factors, such as your risk tolerance, time horizon and investment objectives. This will represent 95% of your combined portfolio.

Tactical asset allocation

We implement an active management portfolio strategy or tactical asset allocation with the remaining 5% of your combined portfolio to take advantage of opportunities such as market pricing anomalies or strong market sectors.